At the beginning of January, the 2024 ZIBS Annual Academic Forum, themed Responsibility and Opportunity: Building an ESG-Driven Global Business Ecosystem, was successfully held in the International Campus. The forum delved into cutting-edge topics such as data intelligence, environmental science, fintech, digital innovation, and corporate renewal. It aimed to share the latest research findings, innovative ideas, and practical experiences, offering profound insights and strategies for the sustainable development of global business, technology, and education.

This issue of the ZIBS Insights spotlights the keynote speech delivered by Richard Barker, professor at the Saïd Business School, University of Oxford. He addressed the significant role of sustainability reporting in economic growth. Below is a summary of the key points.

Economic Growth and Environmental Impact

The rapid rise in global GDP since the Industrial Revolution has been paralleled by a dramatic increase in atmospheric CO₂ and environmental degradation. Historical data reveals that, for most of human history, global GDP growth remained relatively flat. It was only after the Industrial Revolution that a sharp acceleration occurred, particularly in the postwar period, with notable growth from China’s economic expansion in recent decades. However, this surge in economic activity has come with significant negative environmental externalities.

This dual growth trajectory—economic expansion alongside rising greenhouse gas emissions—raises fundamental questions about the sustainability of current development models. While economic growth has improved living standards worldwide, it has also led to serious environmental challenges. Global environmental indicators such as deforestation, freshwater depletion, and biodiversity loss are all closely linked to the growing consumption driven by economic growth. For example, the Amazon rainforest, which plays a crucial role in regulating the global climate, is facing severe deforestation, largely driven by agricultural expansion, particularly beef production. Notably, beef farming accounts for 41% of global deforestation, exacerbating the risk of climate disruption.

Deforestation, especially in tropical regions, poses significant environmental threats. The Amazon, in particular, is a delicate ecosystem that generates its own climate. It is estimated that should deforestation reach around 20% (a level that is not far off), the Amazon may no longer maintain its ecological balance, leading to collapse. This scenario underscores the urgent need for sustainable land-use policies to prevent irreversible damage to vital ecosystems.

The burning of fossil fuels remains the primary source of the rise in CO₂ emissions, driving global warming and increasing environmental costs. The environmental impact of unsustainable growth is evident in the increasing frequency and severity of natural disasters, such as floods and wildfires. These events have a high economic cost, and the ongoing damage caused by climate change is expected to escalate in the coming years.

In this context, the pressing need for a shift towards sustainability has never been clearer. The current economic model, which has long treated environmental resources—such as the atmosphere and forests—as public goods—can no longer continue. As economic activities intensify, the strain on resources becomes more apparent. The risks of continuing on this path are high, and the transition to sustainable development is not just necessary for the environment but also for long-term economic stability. Investing in sustainability is essential, as the costs of inaction are far greater than the investments required to transition to a more sustainable future.

EVs: Opportunities in Green Technology

This shift toward sustainability is exemplified by the rise of electric vehicles (EVs). The market for EVs has seen rapid growth, especially in China, where government incentives have driven adoption. This shift presents businesses with opportunities to innovate and capture market share in a transforming industry. Today, China is emerging as a dominant player in the global auto industry, particularly in electric vehicles. Tesla’s success, becoming the world’s most valuable car company, highlights the growing importance of sustainability and innovation. Traditional carmakers, such as Volkswagen, are now facing challenges, with Volkswagen even closing factories in Germany as part of the transformation toward electric mobility.

This transition presents both challenges and opportunities, reshaping the automotive industry. As demand for sustainability grows, businesses that embrace electric vehicles can position themselves for success in a rapidly changing market.

IFRS S1 and IFRS S2 Standards

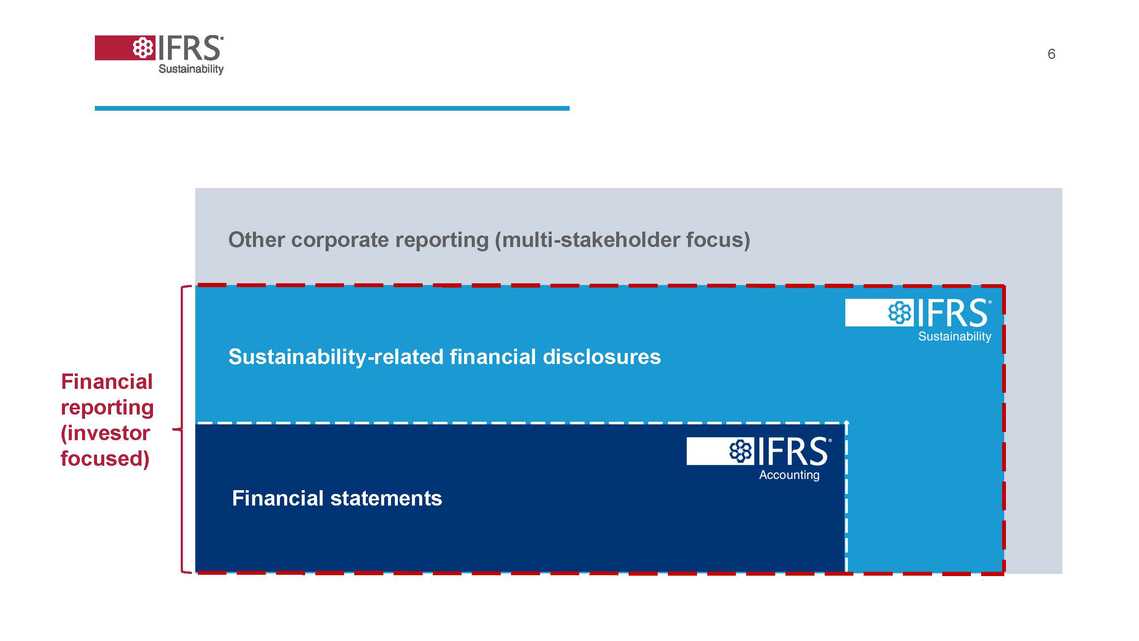

Traditionally, sustainability reporting focused on impacts on stakeholders, such as water emissions, deforestation, and resource use. It was more about business impact rather than investor-oriented reporting. However, this is changing. Sustainability reporting is now increasingly aligned with investor interests. It’s no longer just about negative impacts or Corporate Social Responsibility (CSR), it’s becoming an integral part of financial reporting.

To respond to this growing need for comprehensive and standardized sustainability reporting, the International Sustainability Standards Board (ISSB) published the inaugural sustainability disclosure standards: IFRS S1 and IFRS S2. IFRS S1 is a general and fundamental standard that requires the disclosure of material information about sustainability-related risks and opportunities to meet investor needs. It incorporates the architecture of the Task Force on Climate - related Financial Disclosures (TCFD). The standard also requires industry - specific disclosures. For matters other than climate, relevant sources are provided to assist companies in identifying information such as sustainability - related risks and opportunities. To ensure the relevance, IFRS S1 can be used in conjunction with Generally Accepted Accounting Principles (GAAP), which also establishes a connection between sustainability information disclosure and financial statements.

IFRS S2 focuses on climate - related disclosures. This standard also incorporates the recommendations of TCFD. IFRS S2 should be used in tandem with IFRS S1 and requires the disclosure of information on climate - related material risks and opportunities, including physical risks (such as those resulting from an increase in extreme weather events) and transition risks (such as changes in business operation methods brought about by policy actions and technological changes). At the same time, IFRS S2 also requires industry - specific disclosures. Since sustainability - related issues vary by industry, it is crucial that different industries have different measurement standards. These disclosures are supported by accompanying guidance based on the Sustainability Accounting Standards Board (SASB) standards. Currently, the demand for climate - related disclosures is growing at a rapid pace. Any industry or company that fails to act promptly may fall behind.

Global Commitment to Sustainability Standards

The importance of sustainability reporting is reflected in the growing global commitment to adopting standards like the ISSB framework. Over 20 jurisdictions have already committed to implementing these standards within their regulatory frameworks, covering approximately 55% of global GDP, over 40% of global market capitalization, and more than 50% of global greenhouse gas emissions. This widespread adoption of sustainability reporting standards underscores the significance of integrating sustainability into global business practices. As companies increasingly align their reporting with these standards, sustainability becomes a fundamental element of business decision-making, not just a compliance requirement.

Richard Barker emphasized that businesses and investors must actively engage in sustainability reporting, as it plays a crucial role in promoting sustainable economic development. By adopting these standards, companies can not only mitigate risks but also seize new opportunities, positioning themselves for long-term success in a rapidly changing world. Engaging in sustainability reporting is an essential strategy for ensuring business resilience and competitive advantage in an era where environmental and social factors are key drivers of future growth.

*This article is based on the speech made by Richard Barker at 2024 ZIBS Academic Forum. The views and opinions expressed in this article are those of the speaker and do not necessarily reflect the views or positions of ZIBS.

An expert in corporate reporting, Richard’s research and teaching interests span financial accounting and sustainability reporting, with a particular interest in standard-setting. He also has a broad interest in sustainable business, and he leads Oxford Saïd’s initiatives in this area. Richard serves as Chair of the Expert Panel of Accounting for Sustainability (A4S, a Prince of Wales charity). Previous positions include membership of the Corporate Reporting Council (which sets UK accounting standards) and of the Financial Reporting Advisory Board (FRAB, which advises HM Treasury on government financial reporting). He served as Research Fellow at the International Accounting Standards Board (IASB), Chair of the Audit Committee of Cambridge University Press, and Director of the Cambridge MBA and of the Oxford MBA. Richard has an undergraduate degree from Oxford and graduate degrees from Cambridge, and he qualified as a chartered management accountant while working for AstraZeneca. He has been a Visiting Scholar at Stanford University Graduate School of Business and at INSEAD. Richard has won teaching awards at both Oxford and Cambridge, including 'Most Acclaimed Lecturer in the Social Sciences', awarded by Oxford University Student Union.