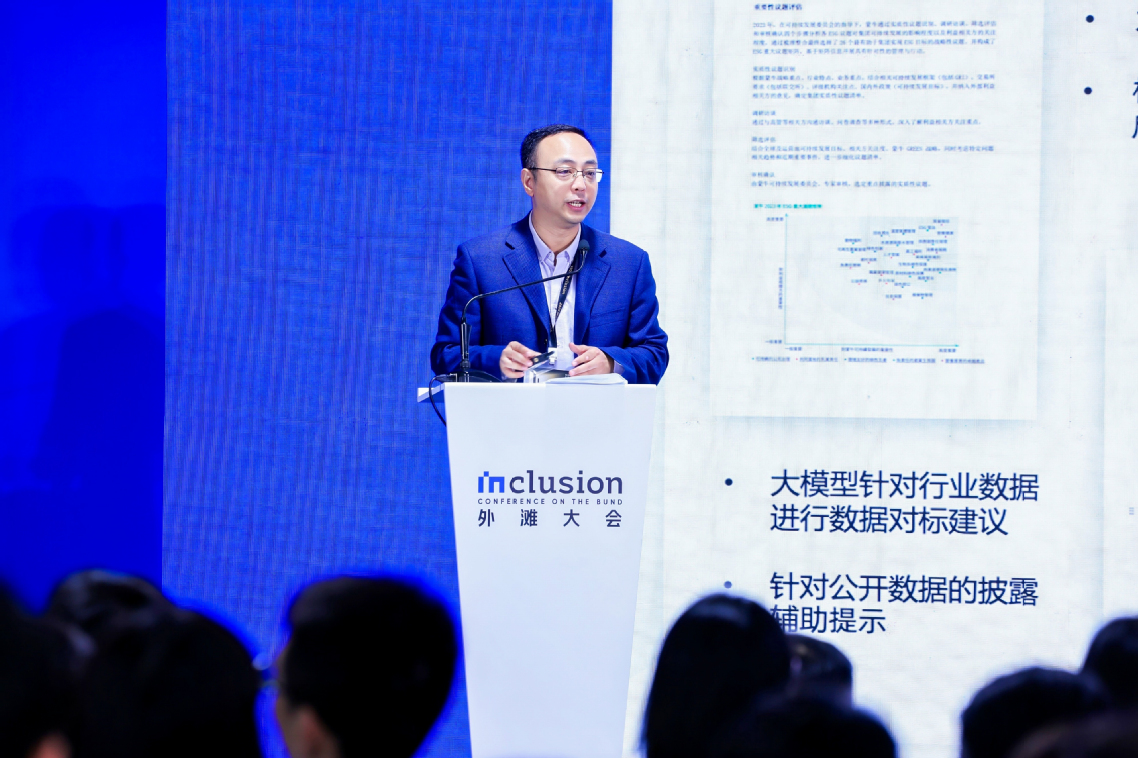

On September 6, the ZIBS Shanghai Forum of the 2024 INCLUSION Conference on the Bond, themed Financial Support for Green and Low-carbon Development, took place at Shanghai's Huangpu World Expo Park. The event was jointly hosted by ZIBS, Beijing Trans Fintech, and Ant Group.

The forum began with opening remarks from MA Jun, Chairman of the Green Finance Committee under the China Society for Finance and Banking, and HUA Jingdong, Vice-Chair of the International Sustainability Standards Board and a member of the ZIBS International Advisory Board. Vice President of the Institute of Finance and Sustainability (IFS) BAI Yunwen followed with an in-depth presentation on the latest developments in China's green finance policies and disclosure systems, while highlighting the expansive opportunities for financial technology in biodiversity and ESG (Environmental, Social, and Governance) sectors. HOU Cuiqin, Head of Global Partnership & Client Solutions, Growth Markets at CFA Institute, discussed global trends in green finance and China's pioneering efforts, emphasizing the importance of talent development.

PENG Bo, CEO of Beijing Trans Fintech, shared insights on how digital capabilities and platforms can optimize the ESG disclosure process, improving both accuracy and efficiency. HUANG Dingwei, Deputy Director of Huzhou Municipal Government Office, showcased the city's progress in building a digital ESG evaluation system and its successes in green financial reform and innovation. XIA Weichun, incoming Secretary to the Board of Directors and General Manager of the Board of Supervisors Office at Industrial Bank, shared the bank's experiences and achievements in ESG practices, underscoring the banking sector's responsibility and opportunities in advancing green finance. ZIBS Dean BEN Shenglin emphasized that the sustained development of green finance requires global collaboration, knowledge sharing, and talent cultivation. He expressed hope that the forum would provide Chinese companies with education on internationally recognized disclosure standards, enhancing their competitiveness in global capital markets and promoting the cross-border flow of green capital.

The forum also featured a roundtable discussion where industry experts and scholars explored cutting-edge topics such as the pathways for green finance development, international cooperation, and the role of fintech in empowering green finance. They presented forward-looking and constructive insights and suggestions.

The forum not only offered valuable guidance for the future of China’s green finance but also contributed Chinese insights and solutions to the global sustainability agenda. Looking ahead, ZIBS will continue to collaborate with partners from various sectors, deepening its exploration and practice in green finance to contribute further to the achievement of global sustainability goals.